What is the best phase of the real estate market cycle to purchase a second home on the Texas coast?

It can always be a good time to buy, at the right price and for the right strategy, but it’s important to know the cycle and have expert advice, and a developer-investor would act sooner than a second homeowner.

- A successful person in a metro often doesn’t make a real estate expert on the Texas coast. Fortunately, we can help, as we’ve spent the last twenty-five years tracking data and learning lessons that we like to share.

- The Real estate market cycles repeat but with unpredictable timing; never-the-less, understanding the housing market cycles can make or break the success of investments.

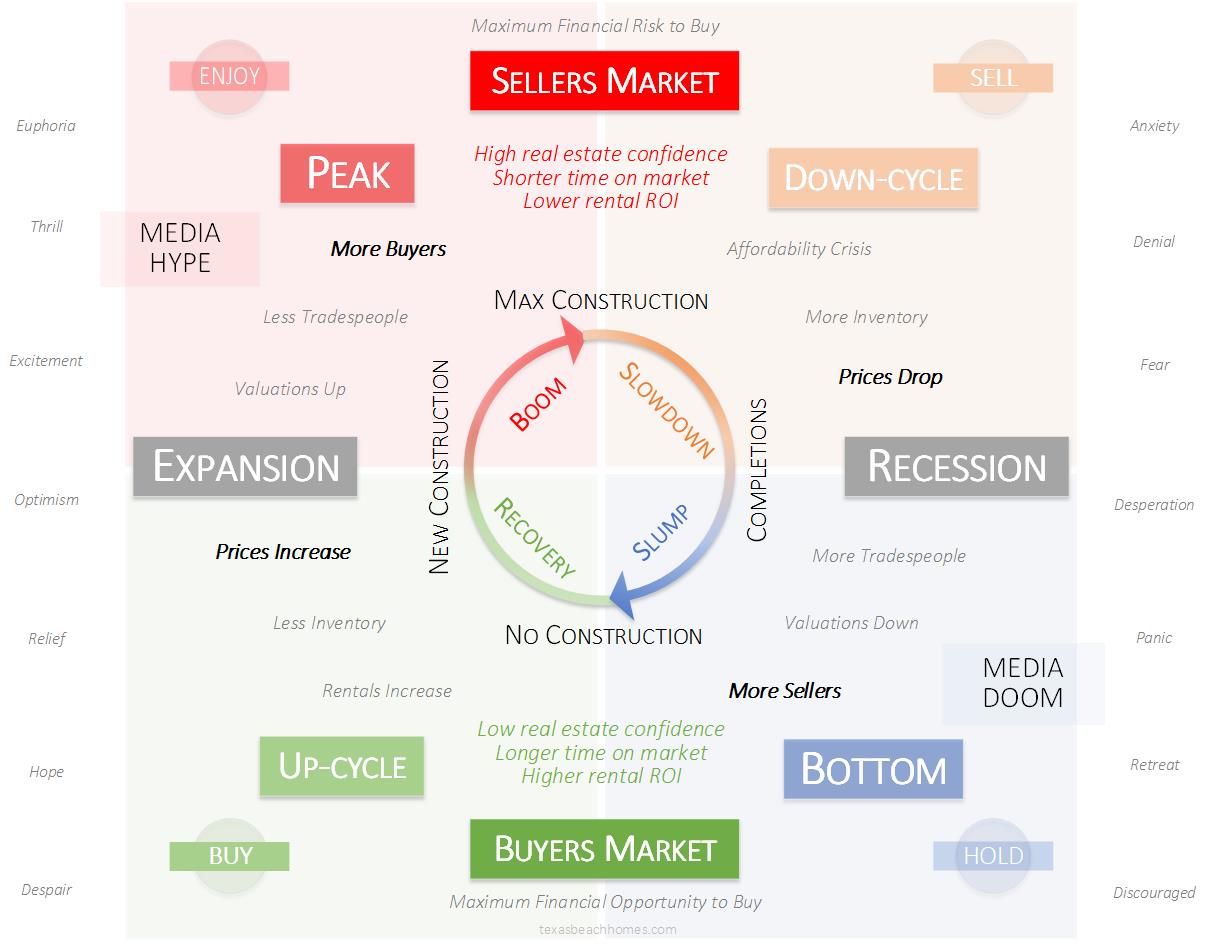

The Recovery phase is considered the time to buy because prices have stopped falling and everyone else is still bearish. You can benefit from below-market prices in an economy that is about to boom.

The real estate housing market cycle is a repeating pattern of changes in the supply and demand for housing, which affects prices, construction activity, and market sentiment. The cycle typically includes the following stages:

- Boom: This is a period of increased demand for housing, rising prices, and increased construction activity. During this stage, the market is characterized by low interest rates, a strong economy, and optimistic consumer sentiment. Many construction projects will begin during this phase due to economic growth. Property prices are high, and it is a seller’s market.

- Expansion – involves the acquisition of additional properties, development of new properties, or the expansion of existing properties, driven by market demand, growth opportunities, or strategic objectives to increase revenue, market share, or brand recognition, and can require significant investments of time, money, and resources.

- Peak: This is the point at which housing prices have reached their highest level and demand begins to slow down. The market may become overpriced, and there may be signs of a slowdown in the economy. This is the worst time to invest in properties.

- Slowdown: This stage is characterized by declining demand, decreasing prices, and reduced construction activity. Interest rates may start to rise, and the economy may begin to slow down.

- Recession – a decrease in economic activity, which leads to a reduction in demand for real estate, which causes property values to decline, and the volume of transactions to decrease. As a result, real estate development and investment slows down, and construction projects may be put on hold.

- Bottom: This is a period of significant decline in housing demand and prices, and a decrease in construction activity. Unemployment rates may increase, and consumer sentiment may be negative. This is a time to look for deals to purchase below market value.

- Recovery: This stage is characterized by a return to growth in the housing market, with increased demand, rising prices, and increased construction activity. Interest rates may remain low, and the economy may start to recover.

It’s important to note that the real estate housing market cycle can vary in length and intensity, and can be influenced by a variety of factors, including economic conditions, consumer sentiment, product innovations and government policies.

- The best time [for you] to buy depends on your financial situation, long-term goals, and risk tolerance. In general, the “buy low, sell high” adage applies to the real estate market, so it may be advantageous to buy during a period of declining prices, such as the Slowdown or Slump phase of the cycle. However, during these phases, there may also be increased uncertainty and risk in the market, which could result in further price declines.

- On the other hand, during the expansion and peak phases, prices are typically higher, but there may be more stability in the market. If you’re able to afford it and are looking for a long-term investment, buying during these phases may be a good option.

New construction activity and property cycles

New construction activity is an important indicator of the property cycle. The property cycle refers to the natural fluctuations in supply and demand for property that occur over time, driven by various economic, social, and environmental factors. The property cycle typically includes four phases: expansion, peak, contraction, and trough.

- During the expansion phase, demand for property is high, and prices are increasing. As a result, new construction activity tends to increase as developers rush to take advantage of the favorable market conditions. This can lead to an oversupply of property as the market approaches the peak phase.

- During the peak phase, demand for property begins to slow, and prices may begin to level off or even decline. Developers may continue to build new properties, but at a slower pace. As the market moves into the contraction phase, demand for property continues to decline, and prices fall further. Developers may stop building new properties altogether as the oversupply of property becomes apparent.

- Finally, in the trough phase, demand for property reaches its lowest point, and prices are at their lowest. Developers may still be hesitant to build new properties, but as the market starts to recover, construction activity may pick up again.

In summary, new construction activity tends to increase during the expansion phase of the property cycle, slow down during the peak and contraction phases, and may pick up again during the recovery phase. By monitoring new construction activity, investors and real estate professionals can gain insight into the current phase of the property cycle and make informed decisions about buying, selling, and developing property.

What you can learn from the property cycle

- Recovery phase prices usually start higher than during the last recovery.

- Property cycles have different time variances in different areas.

- It is normal for property prices to go up and down.

- Buy at the bottom of the cycle and sell at the top of the cycle.

- Do not over-leverage at the peak of the property cycle.

- Do not panic-sell when prices are dropping.

- Be a seller when everyone else is buying

- Be a buyer when everyone else is selling

It’s important to carefully consider all the factors involved, be wise and consult with us before making an investment decision.

| a Market in decline when: | a Market is growing when: | |

| Decrease in home prices Increase in time on market |

Increase in home prices Decrease in time on market |

The Historical 18 Year Real Estate Cycle

A stunning aspect of the real estate cycle is not its inevitability but rather its regularity. Economist Homer Hoyt, through a detailed study of the Chicago and broader US real estate markets, found that the real estate cycle has run its course according to a steady 18-year rhythm since 1800! Harvard University / Hoyt’s statistics predict a bottom ~2024, which oddly enough correlates with Google’s demand prediction!

View the Historical Cycles Chart

Read More Real Estate Market Analysis

TexasBeachHomes offers real estate analysis to help you find the best investment property for your specific needs. It is always advisable to have a steady income and cash reserves.

Also see:

Leave a Reply

You must Register or Login to post a comment.

Become a registered member, it is fast, fun, and free! Gain access to sales analysis, conversations, and much more! Texas state law requires membership before we can share sales information or talk about subjects relevant to ownership. See our membership page for more details.