Texas Coast Real Estate has been hot in 2023!

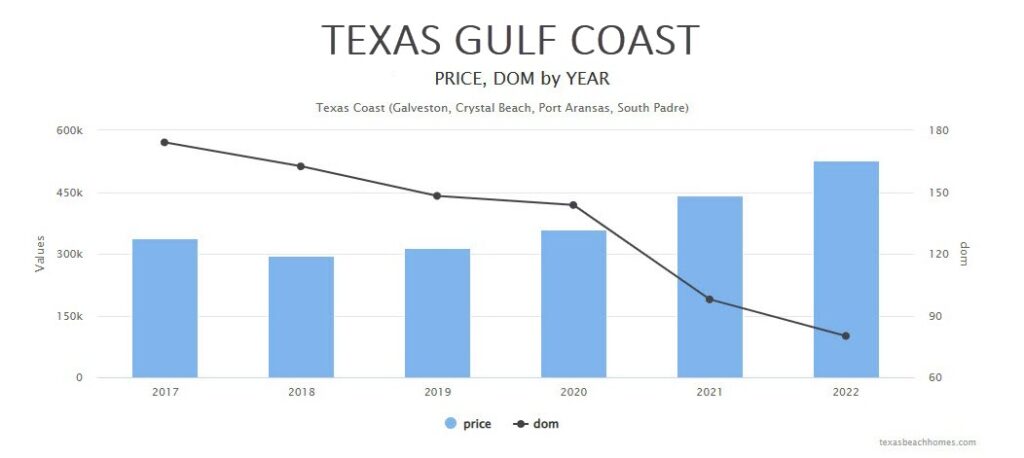

The Texas coast real estate markets have never looked better! Prices are up and the days-on-market shorter. Property is selling for more – and – faster.

The Texas coast real estate market dashboard below shows this ideal market, so how can a big price correction be coming soon?

Google Trends Predicts 40% Market Correction in 2024

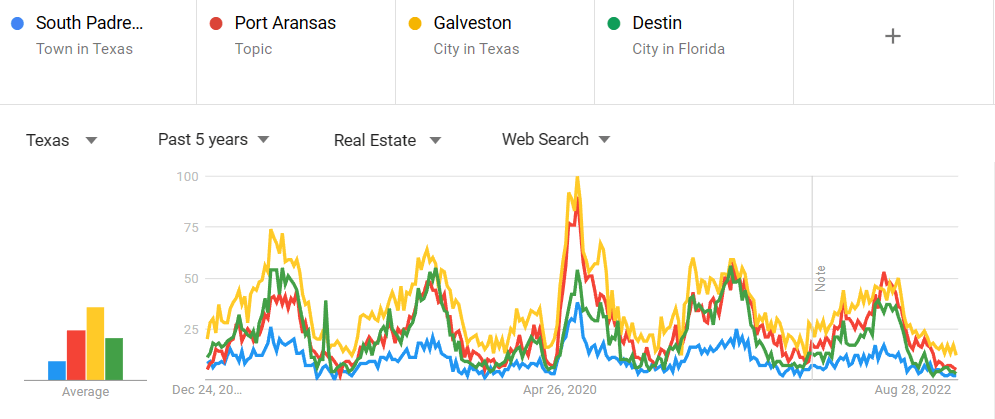

Google Trends allows researchers to track and compare the popularity of certain search terms over time. It is based on search data and can be used to understand the public’s interest in various topics and trends.

- Google Trends is a useful tool for businesses and researchers to track the popularity of specific topics or products and to make informed decisions based on this data. Combined with other data sources, it can provide valuable insights for forecasting demand in the real estate market.

We discovered Google Trends has historically predicted demand on the Texas coast.

- We verified this with website analytics and actual sales for the region, including the previous market correction. Google trends improves our ability to forecast real estate cycle peaks and bottoms with unprecedented accuracy, providing you with insights to continually stay ahead of trends in the market.

Here’s a sample Google trends chart of Texas metro search interest for coastal real estate. You can see a pandemic spike in demand. We’ve not seen such a spike since the 2008 market correction.

MLS Sales for Texas Coast Cities

By themselves, our coastal city sales volumes are too small to forecast demand, and while the entire region has enough volume to be statistically relevant, it rarely reacts in a unified manner.

When we analyze Texas coast MLS sales for all cities, we already see the underlying real estate metrics are starting to correlate with metro sales, which indicates sales are beginning to slow down. And in this real estate cycle, the coastal cities are reacting uniformly to the market bubble and coming correction, here’s why:

The Metros and Texas coast reacted to the pandemic-driven real estate bubble with unprecedented demand and 40% price increases.

- The Federal Reserve’s decade+ quantitative easing money policies put too much cash in the economy.

- The pandemic released this cash with Inflation; the Federal Reserve reacted by increasing interest rates that are expected to remain high for at least another year.

Metro real estate sales are already on a downward trend, and coastal sales metrics indicate the markets are about to trend down.

- The Texas coast second-home markets are seasonal and sticky because people don’t have to move-in or move-out for work-related activities.

- Thus, our coastal markets see prices abruptly drop (or rise) after the summer season that follows a significant change in metro recession-driven demand.

Fortune 500 companies are preparing for a recession.

- Homebuilder sentiment declined and they’re discounting new housing inventory.

- Entrepreneurial leaders are warning against big purchases, and tech companies are laying off workers.

CONCLUSION

Experts forecast a real estate slowdown in the metros for 2023; But our data and Google trends data suggests we will see a price correction on the Texas coast in 2024. Coastal real estate purchased near this market bottom will appreciate and make the ownership experience more enjoyable for you and your family!

OPPORTUNITY

There will be a window of opportunity for profitable coastal real estate investments that won’t become available until we’re near the bottom of the coastal market correction.

Register to be one of the first to know!

ADVICE

Keep an eye on the monthly forecasts to know if (and when) to act, look for real estate sales metrics that correlate with Google Trend’s demand prediction, specifically for average price to decrease; days-on-market (DOM) to increase.

Read more at ridingthepropertywave.com/

Note: it is always a good idea to consider a variety of data sources and to carefully evaluate the limitations of research trends for investment decision-making purposes. Consult with real estate professionals who have local knowledge and expertise to help interpret and analyze the data.

Contact us about what you should do for upcoming market changes!

Reference

Leave a Reply

You must Register or Login to post a comment.

Become a registered member, it is fast, fun, and free! Gain access to sales analysis, conversations, and much more! Texas state law requires membership before we can share sales information or talk about subjects relevant to ownership. See our membership page for more details.